CENTRALIZED KYC

Transforming Customer Relationships and Driving Business Success

See It to Believe It: Experience Our Demo!

Challenges in the BFSI

Unmasking the Hidden Challenges of a Bank / an Fi Without a Centralized KYC Solution

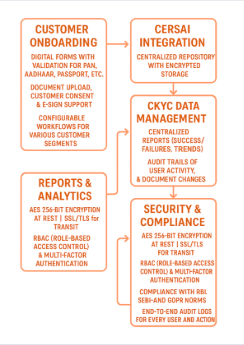

OrangeCKYC is a centralized, regulatory-compliant platform that streamlines the entire lifecycle of Know Your Customer (KYC) operations. Designed for banks, NBFCs, and financial institutions, it ensures seamless onboarding, real-time CERSAI integration, and robust audit trails—enabling you to focus on customer growth while staying fully compliant.

Its role-based access controls, AI-powered document verification, and intuitive dashboard provide an effortless user experience.

By offering multi-factor authentication, automated reminders, and real-time tracking, OrangeCKYC empowers financial institutions to meet regulatory standards while enhancing operational efficiency.

Let the OrangeCKYC be your Onboarding Partner

OrangeCKYC provides a Centralized Platform for Storing and Managing KYC Information, with Seamless Integration to CERSAI for Regulatory Compliances

Our Product in Action: Captivating Snapshots

Learn more about the Comprehensive Modules