DIGITAL CUSTOMER ONBOARDING

Unified Onboarding: 100 + APIs, Custom Workflows, Fraud Prevention, and Multi-Channel Integration

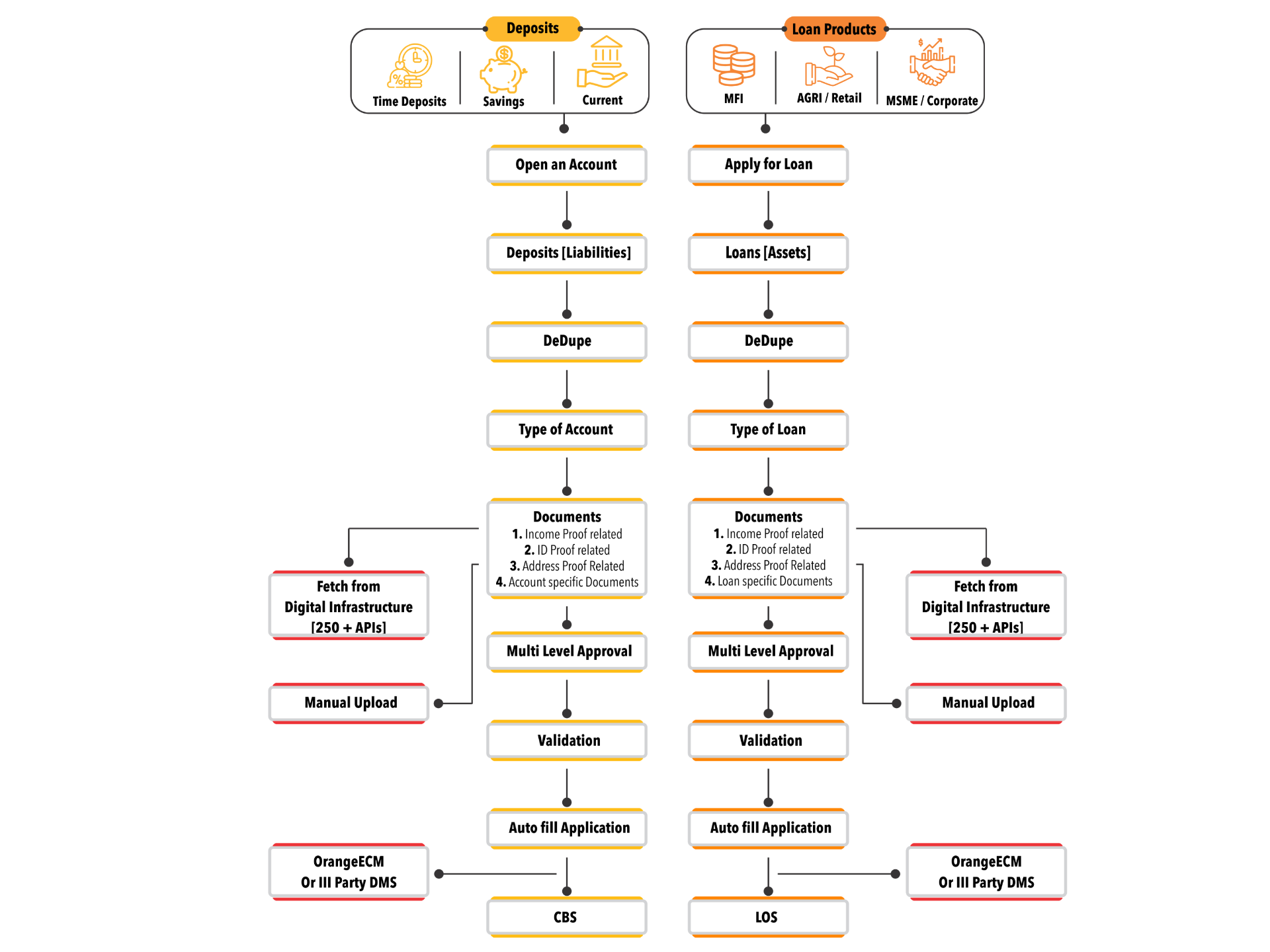

Configurable Products and Processes !

Major Obstacles in Customer Onboarding for Banks and Financial Institutions

From Excessive Manual Data Entry to Inefficient Digital Verification – Key Issues Unveiled

OrangeEMBARK, our state-of-the-art Digital Customer

Onboarding Solution, meticulously designed for facilitating

the acquisition of both assets [Loans] and liabilities

[Deposits] products, while keeping pace with India's swiftly

advancing digital infrastructure.

This ground-breaking platform, harmoniously integrating

with more than 100 APIs, streamlines the onboarding

process by employing advanced identity verification tools

such as eKYC, vKYC, and more.

Adhering strictly to

regulatory compliance, it enhances the customer experience

by guaranteeing a quick, secure, and easy-to-use process for

today's digital-savvy India.

Process Flow - OrangeEMBARK

MSME Loans

Retail Loans

MFI Loans

Agri Loans

Market Place Integrations

Our platform offers a marketplace of seamless integrations, including government schemes, identity validation, and communication gateways. Some of these integrations are already in place, while others are in progress, with the capability to incorporate many additional portals as needed.

Our Product in Action: Captivating Snapshots