Transform Loan Origination:

Easy Configurability, Minimal / No Data Entry. Design Your Application and Processes.

Affordable & Fast Deployment!

Top Challenges for Banks and Financial Institutions with Loan Origination Products

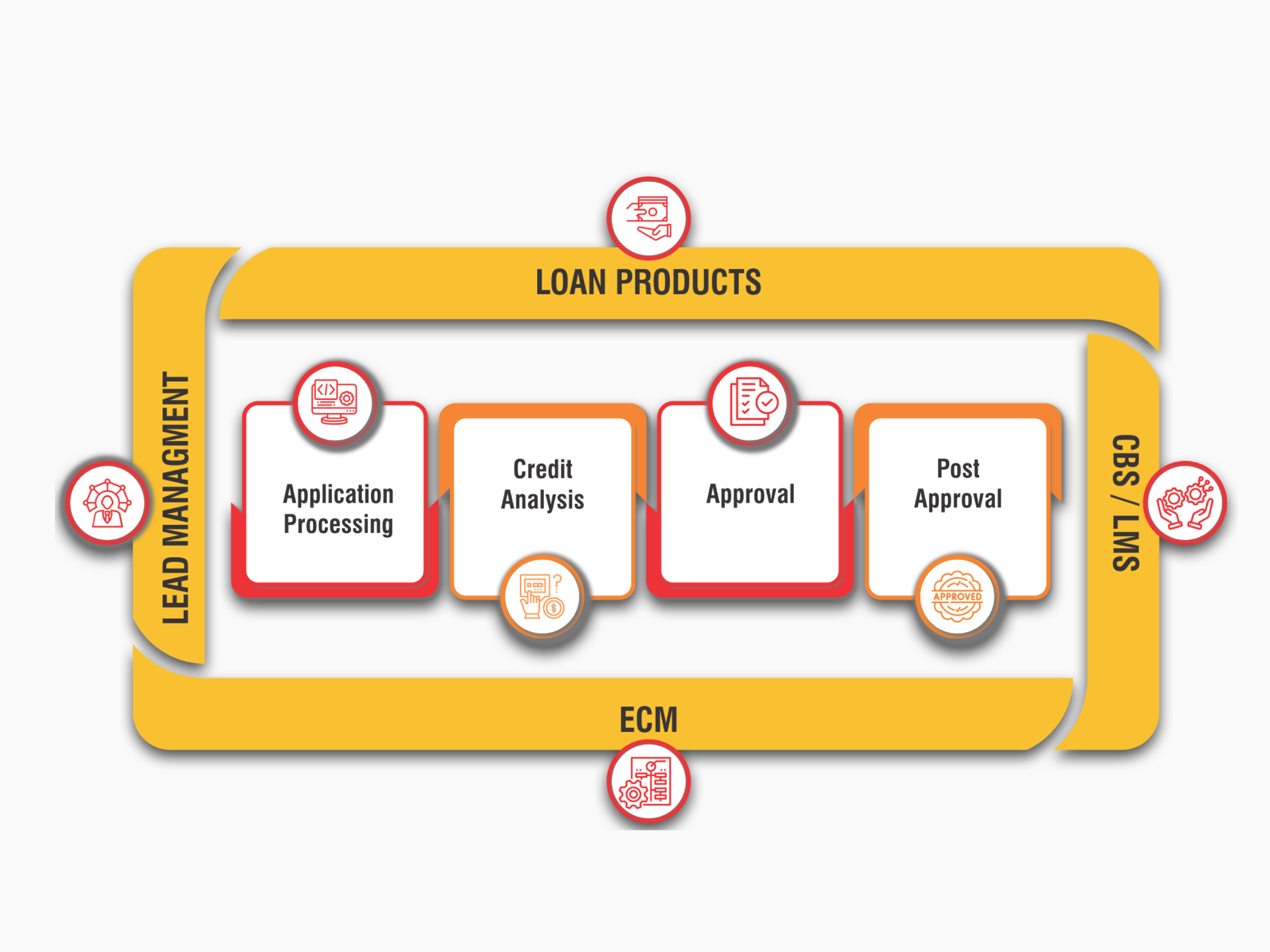

OrangeLOS, an open configurable AI/ML powered platform, with dynamic workflows redefines the Loan origination process.

It comes with a configurable Business Rule

Engine (BRE) and Credit Rule Engine (CRE) that

automates everything from Lead management

[OrangeLEAD] to disbursement and agreement

signing.

Its powerful onboarding platform

[OrangeEMBARK], equipped with over 100+

APIs, ensures error-free and fraud-free

operations.

Plus, with an integrated Enterprise

Content Management system [OrangeECM],

it promotes easy storage, access, and sharing of

vital documents, enabling faster and better

credit decisions, scalability, and cost

optimization.

Loan Products Supported

Our platform offers full customization with a dynamic rule engine for business and credit rules, enabling instant configuration of secured and unsecured loan products directly from the front end. Easily add or modify products and processes, with instant updates. Here's a quick overview of the loans we support :

Retail Loans

MSME Loans

MFI Loans

Agri Loans

Market Place Integrations

Our platform offers a marketplace of seamless integrations, including government schemes, identity validation, and communication gateways. Some of these integrations are already in place, while others are in progress, with the capability to incorporate many additional portals as needed.

Our Product in Action: Captivating Snapshots